Watch Me JUST PREDICT The Market With FVG. (Works Everytime) YouTube

In this video we are covering fair value gaps, what they are, how to spot them and then how you can use them in your own trading strategies.🔵 Thanks to Jig.

Fair Value Gap Basics TrendSpider Blog

Fair Value Gaps (FVG) and Liquidity Voids are price ranges you can exploit for better entries and exits on your trades. They're similar concepts, so let's look at them from the top and break it down. Think of FVG and Liquidity voids as soft-spots in the market. They are paths of least resistance.

What Is A Fair Value Gap/Imbalance? BROKEN DOWN Free Download Download forex Robots

Fair value gap refers to the difference between the current market price of a currency pair and its fair value. This gap is a result of various factors that affect the currency markets, including economic and political events, market sentiment, and market participants' behavior. The fair value of a currency pair is the theoretical value of.

Fair Value Gap

E-mail address: [email protected] (A. Subrahmanyam). 0304-405X/02/$-see front matterr 2002 Published by Elsevier Science B.V. PII: S 0 3 0 4 - 4 0 5 X ( 0 2 ) 0 0 1 3 6 - 8. association among trading activity, liquidity, and stockmarket returns using a lengthy and recent set of high frequency data.

EXPLAINED A Bearish Fair Value Gap (FVG) Smart Money Concepts for TVCSA40 by Timonrosso

Fair Value Gaps are anomalies in the market, signaling imbalances between buying and selling forces. These gaps manifest in a three-candle sequence on price charts, creating a distinctive pattern. The psychology behind the fair value gap is that these gaps emerge due to inefficient price delivery.

Fair Value Gap Basics TrendSpider Blog

Fair value is the estimated price at which an asset is bought or sold when both the buyer and seller freely agree on a price. Individuals and businesses may compare current market value, growth.

Fair Value Gap Basics TrendSpider Blog

FVG in trading means the fair value gap, which refers to the difference between the current value of an asset or currency and its fair value due to inefficiency or imbalance in the market. Fair value gap is the most important term in price action trading that a trader should understand.

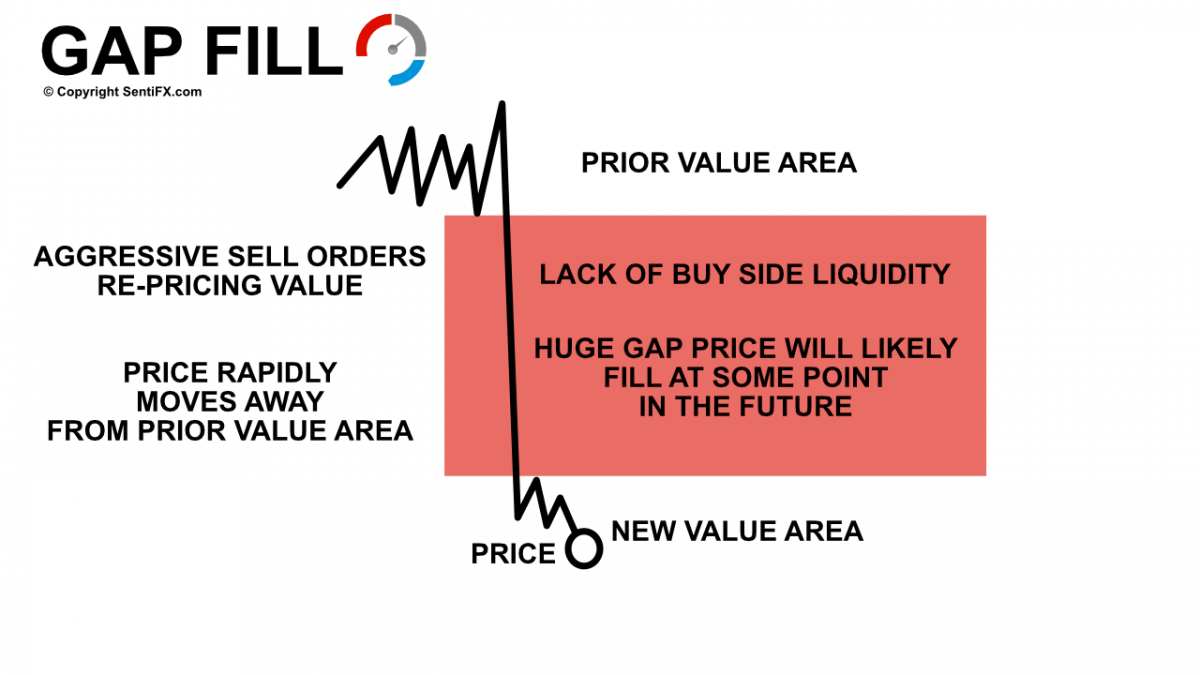

Liquidity Gap Fill Trade SentiFX

Fair value gaps (FVG) highlight imbalances areas between market participants and have become popular amongst technical analysts. The following script aims to display fair value gaps alongside the percentage of filled gaps and the average duration (in bars) before gaps are filled.

Fair Value Gap in Trading PDF Guide Trading PDF

In this video, I discuss my fair value gap theory in detail. Fair value gaps are the most power pd array. They show the intention of price.Join the Money Mak.

Difference between order block and fair value gap ForexBee

A fair value gap is an indicator used by price action traders to identify market inefficiencies and imbalances. Traders can use the fair value gap indicator to identify and analyze these gaps on charts, potentially informing their trading decisions. The fair value gap can be used as an indicator for bearish bias trades when price fills the gap.

Fair Value Gap Basics TrendSpider Blog

Fair Value Gaps (FVGs) are powerful tools used by traders to identify market imbalances and inefficiencies. FVGs occur when buying or selling pressure leads to significant price movements, leaving gaps on price charts. There are two types of FVGs: Undervalued FVGs and Overrated FVGs.

Fair Value Gap in Cryptocurrency ForexBee

Fair Value Gaps are most commonly used amongst price action traders and are defined as instances in which there are inefficiencies, or imbalances, in the market. These 'imbalances' simply suggest that buying and selling are not equal.

About Fair Value Gap

Fair Value Gaps (FVGs) are powerful tools traders use to identify market imbalances and inefficiencies. FVGs occur when buying or selling pressure leads to significant price movements, leaving behind gaps on price charts. FVGs can be identified through technical analysis involving the analysis of candlestick patterns and price chart patterns.

FVG in Trading A Complete Guide to Fair Value Gap ForexBee

The Fair Value Gap indicator is designed to find instances of inefficiencies, or imbalances, in the market. These imbalances suggest that buying and selling are not equal and can create areas.

Fair Value Gap, inefficiencies, imbalance, and Liquidity void Zeiierman Trading

The Fair Value Gap, or FVG, is a widely utilized tool among price action traders to detect market inefficiencies or imbalances. Sometimes you will even see them labeled as inefficiencies by other traders.

FVG in Trading A Complete Guide to Fair Value Gap ForexBee

Fair Value Gaps - Everything to know0:00 Intro0:26 FVG 2:05 FVG Examples2:46 BISI / SIBI3:15 BISI / SIBI Examples3:50 Consequent Encroachment (CE)4:53 CE Ex.